It’s the end of 2025, and you’re probably thinking about starting your own prop firm…maybe something to launch early 2026.

By the time you get everything ready, tech, payments, rules, legal, all of it, it will be 2026. So you might as well plan it right now, before everyone else wakes up and decides to launch one at the same time.

I remember the first time someone asked me how much it costs to start a prop firm. I shrugged and said I don’t know. couldn’t be bothered to find out. Probably very expensive. Then I actually looked into it. Turns out it’s not that expensive at all. Which explains why every week there’s a shiny new prop firm logo popping up.

This isn’t some secret. All the info’s already out there on the web. I’m not pretending to be clever here…I’m just pulling it together and making it easier to read.

Truth is, there are already like 50 “how to start a prop firm” articles now. I wrote one ages ago when the only competition was badly SEO’d blogs, and even that ranked. Now everyone’s at it.

And isn’t it annoying when you click an article about how to start a prop firm, and halfway through it suddenly turns into tips on how to trade with a prop firm? You know why that happens? Because ChatGPT can’t tell if you’re a founder trying to start a firm… or just a trader looking to start a challenge.

So here’s me, trying to put out a fresh version for 2026…one that’s readable, and a bit less boring than the rest. Let’s get serious.

What is a Prop Firm Today?

A prop firm, short for proprietary trading firm, is a company that gives traders money to trade with. The trader does not need to put in their own big deposit. Instead, they take a test, called an evaluation. If they pass, they get a funded account. The firm and the trader then share profits.

Here is how most modern prop firms work:

- Traders buy access to challenges (for example $100, $200, or $500 depending on account size).

- The firm tests them on targets and rules, like profit goals and maximum drawdowns.

- Most traders fail. That is where the firm earns most of its revenue.

- A small group passes, earns payouts, and sometimes has their trades copied in real markets.

This is why tech, payouts, and risk rules matter more than your shiny logo.

Is a Prop Firm Profitable in 2026?

If you’re looking to start next year, then yes, but only if you manage costs and risk. Most revenue comes from traders paying for challenges. The real danger shows up when payouts start outpacing what you collect, or when bad liquidity and sloppy risk controls drain your balance faster than you can patch it.

Here are the key things that decide if a prop firm makes money:

- How many traders sign up each month

- Average challenge price (entry fees)

- Pass rate (how many reach funded status)

- Refund rules (some firms give a refund on the first payout)

- Payout ratio (how much of profits go to traders)

- Chargebacks (when traders dispute card payments)

Example ranges for new firms:

- Pass rates: 2–8 percent for 2-step models, 6–15 percent for 1-step

- Payout share for funded traders: 5–25 percent of gross revenue

- Refunds: 10–40 percent of purchases depending on rules

- Chargebacks on card traffic: 0.6–2.5 percent if not well controlled

It’s a risk business dressed up as education. If you can’t handle volatility, don’t start.

Realistic Costs to Start a Prop Firm in 2026

You do not need six figures to launch. Costs vary by tech, marketing, and legal setup. Here are realistic ranges in 2026:

One-time setup costs

- Website and brand: $2,000–$10,000

- Legal docs and policies: $3,000–$15,000

- Payment gateway and KYC onboarding: $1,000–$5,000

Monthly recurring costs

- CRM, dashboards, risk tools: $1,500–$6,000

- Trading platform license: $400–$3,000

- Hosting and infrastructure: $200–$1,000

- KYC checks: $1–$4 per user

- Support systems: $50–$500

- Payment processing fees: 2.5–6 percent on cards, 0.9–2 percent on other methods

Marketing budget

- Small launch: $3,000–$10,000 per month

- Scaling: $15,000–$50,000 per month

Choose Your Evaluation Model

The evaluation model is the heart of every prop firm. It decides how many traders pass, how much revenue you collect, and how much risk you take on payouts.

The three most common models are:

| Model | Profit Target | Daily Drawdown | Max Drawdown | Min Trading Days | Time Limit | Reset Option | Typical Pass Rate | Payout Risk |

| 1-Step | 8–10% | 4–5% | 8–10% | 3–5 | Often none | Paid reset or free retry | 6–15% | Medium–High |

| 2-Step | Step 1: 8–10% / Step 2: 4–6% | 4–5% | 8–10% | 5–10 | Often none | Paid reset | 2–8% | Low–Medium |

| Instant Funding | None | 3–4% | 6–8% | 0 | None | Pay for upgrade | – | High |

How to choose:

- If you run high-quality traffic with serious traders, 1-step can work.

- If you buy a lot of cold traffic from ads, 2-step is safer.

- Instant funding looks attractive, but if not managed well, payouts can outrun revenue.

Most firms use a mix. For example, 70 percent 2-step, 20 percent 1-step, and 10 percent instant.

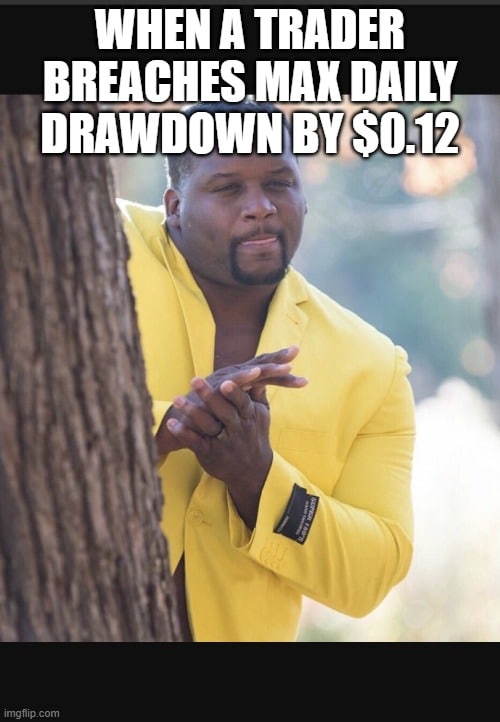

Write Rules That Don’t Blow Up Payouts

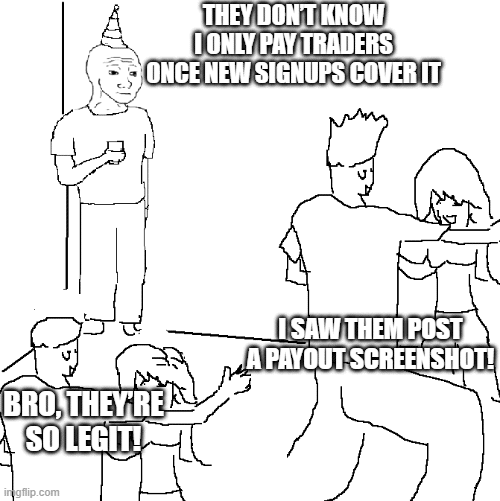

Rules protect your firm from paying out more than you collect. Weak rules make you a target for fraud, copy-trading rings, and payout abuse.

Core risk rules

- Daily loss limit: Traders cannot lose more than 4–5 percent in a single day.

- Max drawdown: Stop-out if total account equity drops by 8–10 percent.

- Trailing vs static: Trailing adjusts with peak equity. Static is fixed from the start. Trailing reduces risk but feels harder for traders.

Trading policies

- News trading: Many firms block trading during high-impact events.

- Weekend holding: Decide if trades can stay open over weekends or not.

- Lot size and frequency limits: Stop flash abuse from bots or high-frequency scalpers.

Abuse controls

- Multi-account abuse: Prevent traders from buying 10 accounts and copying trades to farm payouts.

- Copy or inverse trading rings: Use tech to detect traders copying or mirroring each other.

- Latency arbitrage: Block bots that exploit price delays between brokers.

SOP (Standard Operating Procedure) for rule breaches

- Capture evidence (trade logs, risk events, platform screenshots).

- Review time within 48 hours.

- Clear appeal flow where traders can submit a ticket.

- Keep an audit trail so you can defend disputes and chargebacks.

Key performance indicators (KPIs) to track

- Breach velocity: How quickly traders hit rules after starting.

- Appeal rate: Percentage of traders who dispute rule breaks.

- Upheld rate: Percentage of appeals where the firm decision is confirmed.

Build Your Prop Firm Tech Stack

Prop firms are built on tech. You can get all the traders in the world, but if your systems aren’t solid, they won’t stick around. The big reason firms shutdown in 2024? Bad tech and poor business sense, not a lack of new traders.

Here are the must-have systems:

CRM and Client Portal

- What it does: Handles onboarding, KYC, payouts, and support tickets in one place.

- Why it matters: Without automation, you end up with spreadsheets and manual errors.

- Cost range: $2,000–$10,000 per year (white-label vs custom).

Payout Automation

- What it does: Sends trader payouts automatically through PayPal, crypto, or bank transfer.

- Why it matters: Delayed payouts kill trust. Fast payouts keep traders loyal.

- Cost range: $1,000–$5,000 per year plus transaction fees.

Risk Management System

- What it does: Monitors trader accounts in real time. Flags copy-trading, news spikes, and rule breaks.

- Why it matters: Stops you from paying out fraudulent or unsustainable strategies.

- Cost range: $3,000–$15,000 per year depending on features.

Broker and Platform Integrations

- What it does: Connects your CRM to trading platforms like cTrader, DXTrade, Match-Trader, or Rithmic (for futures).

- Why it matters: Traders need a smooth sign-up, account creation, and funding process. If it breaks, refunds and complaints pile up.

- Cost range: $5,000–$20,000 per year depending on platform.

Website and Checkout

- What it does: Gives traders a front door to buy evaluations. Should include FAQs, rule pages, and support.

- Why it matters: A bad website kills conversions even if your ads are good.

- Cost range: $2,000–$8,000 for setup, then hosting fees.

✅ Pro Tip: Start with white-label tools (fast setup, low cost). Later, if you grow big, consider building custom software to reduce long-term fees and stand out from competitors.

Prop Firm Marketing Strategy

You can build the best tech, but if traders don’t find you, the firm dies. Prop firm marketing is where most new firms overspend or waste money. The trick is to focus on channels that bring traders who actually pay for challenges.

Paid Ads (Fast but Expensive)

- Where: Meta Ads (Facebook/Instagram), Google Ads, YouTube.

- Why: These reach traders fast. You can test pricing models and get volume.

- Budget: $10,000–$30,000 for small firms, $50,000+ if scaling.

- Pro Tip: Always test multiple creatives (memes, payouts screenshots, video ads). Ads burn out quickly.

Influencers (High ROI if chosen right)

- Where: Twitter/X, YouTube, TikTok.

- Why: Traders trust personalities more than brands. Influencers can drive challenge sales directly.

- Cost: $1,000–$5,000 per shoutout or collab.

- Pro Tip: Don’t waste cash on big names. Pick mid-tier traders with 20k–100k followers — they convert better.

SEO & Content (Slow but Long-Term)

- What to target: “Best prop firm,” “prop trading challenges,” “instant funding prop firm.”

- Why: High intent. Traders searching these are ready to buy.

- Tools: SEO blog posts, case studies, payout reports, prop firm comparisons.

- Timeline: 3–6 months before traffic builds.

- Cost: $2,000–$8,000 per month if you outsource.

Community Building (Cheap, Sticky Growth)

- Where: Discord and Telegram.

- Why: Traders want to chat, share results, and compete. A strong community lowers churn and increases referrals.

- Tactics:

- Offer free trading rooms.

- Post payouts and leaderboard updates weekly.

- Add referral bonuses (“Bring a trader, get 20% off your next challenge”).

- Offer free trading rooms.

Referral & Affiliate Programs

- What it does: Lets other traders and influencers promote your firm for a commission.

- Why: This is how most firms scale.

- Pro Tip: Start with 10–20% commission per challenge sold.

✅ Key KPI Metrics to Track:

- Cost per Acquisition (CPA): How much you spend per trader sign-up.

- Community Engagement: Active users in Discord/Telegram.

Risk Management & Security Strategy

Most prop firms fail because they ignore risk. Marketing brings traders in, but bad rules and weak risk tools can bankrupt you fast. Risk management is not just about protecting the firm. It’s also about building trader trust; if payouts stop, your brand is dead.

Core Risk Controls

- Daily Loss Limits: Set a hard daily loss (for example 5%). This prevents blowouts in one session.

- Max Drawdown: Use static or trailing. Static is fixed (like -10%), trailing adjusts as account grows. Most new firms underestimate trailing risk.

- Leverage Settings: Higher leverage = higher risk of payout spikes. Match leverage to account size and trader type.

- Trade Restrictions: Decide policies for news trading, weekend holding, and high-frequency scalping.

Abuse Prevention

- Multi-Account Rings: Traders try copy-trading across accounts to pass evaluations. Use IP/device checks and copy-trade detection.

- Latency Arbitrage: Some use lagging feeds to profit unfairly. Set filters and use broker-side protection.

- Inverse Copying: Groups trade opposite directions to guarantee one winner. Monitoring systems must flag this.

Evidence & Dispute SOP

When traders break rules, you need clean evidence. Create a Standard Operating Procedure (SOP):

- Capture screenshots, trade logs, and timestamps.

- Review internally within 48 hours.

- Offer an appeal flow with fixed timelines.

- Share proof with the trader if needed.

This prevents fights online and builds credibility.

KPI Box (Key Risk Metrics)

- Breach Velocity: How fast traders hit rules after starting.

- Appeal Rate: % of rule breaches disputed by traders.

- Upheld Rate: % of decisions confirmed after review.

These KPIs tell you if your rules are too strict, too soft, or too unclear.

Liquidity and Pricing Hygiene

Liquidity is the engine under your prop firm. If your feeds are messy — with rejects, slippage, or unrealistic pricing — traders will call you a scam. A clean and consistent feed is one of the fastest ways to build trust.

LP Selection Checklist

When choosing liquidity providers (LPs), test for:

- Depth of Book: How many levels of pricing beyond top-of-book.

- Reject Rate: Too many rejections = bad execution.

- Slippage Profile: Measure how often traders get worse fills than quoted.

- Weekend Behavior: Some LPs freeze or widen spreads unpredictably.

- Synthetic Indices Policy: Decide if you want to offer synthetic or non-market instruments, and how to disclose them.

Feed Monitoring

Don’t just trust the provider. Use monitoring tools to track:

- Spread anomalies: Sudden spikes that break trader rules.

- Latency: Delay between order and fill.

- Disconnections: Any downtime kills trader trust instantly.

Circuit Breakers

Set up automatic guards:

- Freeze orders if spreads widen beyond a set threshold.

- Pause trading during feed disconnections.

- Reconcile pricing feeds across multiple LPs to spot manipulation.

Incident Logging

Every pricing or liquidity event should go into a log:

- Date, time, instrument, what happened, trader impact, resolution.

- Share summaries with traders if the issue is significant.

This transparency protects you from disputes and shows you are running a professional shop.

Payments, KYC, and Chargebacks

If liquidity is the engine of your prop firm, payments are the fuel lines. Smooth deposits and fast payouts are what traders care about most. Get this wrong, and your reputation is gone.

Payment Mix

You need to offer more than cards:

- Cards: Visa/Mastercard are standard but carry high fraud risk.

- Alternative Payment Methods (APMs): PayPal, Wise, Payoneer — critical for global reach.

- Crypto: USDT, BTC, ETH. Many traders expect it, and it helps with cross-border payments.

Automate Payouts

Manual payouts kill your time and lead to delays. Use an automated payout engine that connects directly to your CRM and trading accounts. Traders should see a payout request → status update → cleared in hours, not days.

KPI Targets:

- Auth Rate: % of card payments accepted.

- Refund Rate: % refunded without dispute.

- Chargeback Rate: Should stay <1%.

- Payout TAT (Turnaround Time): How fast payouts are processed, ideally <24 hours.

Fraud & Chargeback Prevention

- Refund Before Chargeback: Always refund a valid complaint fast. It costs less than fighting a chargeback.

- Dispute Pack Template: Keep pre-built evidence packs for when you need to fight a chargeback. Include logs, IP, challenge rules, trader activity.

- KYC/AML: Automate onboarding with ID and proof-of-address checks. A solid KYC process reduces fraud, double accounts, and regulatory risk.

Standard Operating Procedure (SOP)

- Traders submit payout request.

- Automated KYC check before funds are released.

- Refund policy applies first, chargebacks only as last resort.

- Disputes logged and tracked with resolution outcomes.

Payments are one of the biggest trust signals in this industry. Fast, transparent, and fair systems turn traders into loyal advocates.

Payout Policy That Builds Trust and Survives Scale

Your payout rules decide if traders trust you and if your cash flow stays healthy. Set them once, write them clearly, and automate them.

Payout cadence

- Pick one and stick to it: weekly or biweekly.

- On-demand works only if you have strong risk checks and cash buffers. Most new firms should not start with on-demand.

First-payout buffer

- Add a short buffer before the first payout. Example: first payout after 14 days funded.

- Use that window to run extra checks: KYC, device match, copy-trade scan, news-event review.

Caps that protect you

- Single ticket cap: limit the max payout on one request. Example: $5,000.

- Single day cap: limit total daily payouts per trader. Example: $10,000 per day.

- Rolling cap: set a weekly or monthly ceiling during the first 60 days funded.

Refund link to first payout

- If your policy refunds the evaluation fee on first payout, state it plainly.

- Tie the refund to clean risk results and a minimum payout amount.

- Automate it so staff cannot forget or delay.

Public payout ledger

- Publish weekly totals without doxxing anyone. Show: count of paid traders, total amount, median payout, top 10 ranges.

- Blur names or use trader IDs. This builds trust and avoids privacy issues.

Automation rules

- All payouts run after KYC recheck.

- Block payouts if there is an open breach, device mismatch, or unpaid chargeback.

- Show status in the trader portal: requested → in review → approved → sent (with time stamp).

Support SLA

- Reviews inside 24–48 hours.

- Clear appeal steps if a payout is denied, with evidence shown to the trader.

Legal and Jurisdiction

Get the structure right on day one. Stay out of “broker” territory, protect banking, and keep your data safe.

Entity and banking

- Form a clean, limited-liability company for the evaluation side (website, challenges, support).

- Use a separate company for trading/mirroring if you plan to mirror signals with firm capital.

- Open business bank accounts and payment processor accounts in the company name. Keep payout records and invoices.

Data protection

- Publish a privacy policy.

- Store KYC data with a vetted provider.

- Limit who on your team can see IDs and documents. Log every access.

Plain disclosures that keep you safe

Add short, clear lines in your site footer, checkout, and terms:

- “We do not offer brokerage services.”

- “All evaluations run in a simulated environment.”

- “Funded accounts remain simulated. The firm may choose to mirror trades with its own capital at its sole discretion.”

- “We do not take client deposits for trading.”

- “Payouts are profit shares under a services agreement, not withdrawals from a trading account.”

Terms to avoid

- Do not promise “live market funding” or “real account access” if traders never touch real funds.

- Do not claim “guaranteed profits,” “risk-free income,” or fixed pass rates.

- Do not suggest you are licensed as a broker if you are not.

Claims to avoid in ads

- No screenshots that imply custody of client money.

- No false “regulated by” badges.

- No payout claims you cannot verify with records.

KYC and AML basics

- KYC at sign-up and again before first payout.

- Flag VPNs, mismatched names on cards, repeat chargeback users, and device farms.

- Keep an audit trail for every payout and every breach.

Jurisdiction tips (simple)

- Pick a place where your model fits the rules and banking works.

- Keep the evaluation company where you want trust and marketing to live.

- Keep any trading/mirroring entity separate to isolate risk and manage taxes with your advisor.

- Block countries where your model is not allowed, and say so on your site.

Internal legal checklist

- Company docs signed and stored.

- Terms, risk rules, refunds, and payout policy reviewed by counsel.

- IP and device policy disclosed.

- Chargeback response pack template ready (logs, KYC, rules page, trader history).

- Annual review of terms, privacy, and disclosures.

This setup makes your offer clear to traders, clean for payment partners, and harder to attack.

30/60/90 Launch Plan

Day 0–30 (Foundation)

- Lock rules, T&Cs, and legal disclaimers.

- Set up payments, KYC, CRM, and risk tools.

- Run a soft beta with 50–100 testers to catch bugs.

- Track: signup flow time, KYC failure %, and first payout simulation.

Day 31–60 (Trust Building)

- Bring in first affiliates with clear commission terms.

- Process the first real payouts (publish anonymized proof).

- Tune your appeal process for rule disputes.

- Start posting public stats (pass rate, payout totals).

- Track: payout TAT (turnaround time), affiliate sales share, appeal rate.

Day 61–90 (Scale Mode)

- Turn on paid ads and influencer pushes.

- Add new rails: futures or crypto evaluation tracks.

- Run trader contests and launch a loyalty scheme.

- Track: CAC (cost per acquisition), challenge unit margin, retention.

Ops Playbook

Daily

- Review all breaches (daily loss, max DD).

- Clear payout queue.

- Flag fraud: multi-account, copy-trading, chargeback risk.

- Monitor platform health (latency, order rejects).

Weekly

- Audit pass rates by traffic source (organic, affiliates, paid).

- Check for rule bugs or exploit attempts.

- Review chargeback disputes and refund patterns.

Monthly

- Test pricing models (entry fee bands, payout ratios).

- Review LP (liquidity provider) for slippage, rejects.

- Run an incident drill (server crash, payout freeze, KYC breach).

Common Mistakes That Kill New Prop Firms

Too many prop firms fail in the first year because of shortcuts. Here are the traps to avoid:

- Generous targets with no buffers

If your evaluation targets are too easy, you’ll drown in payouts. Always model pass rates with margin. - Manual payouts

Paying traders by hand does not scale. Delays destroy trust. Automate your payout queue. - One payment rail

Relying only on cards or only on crypto is dangerous. Have at least 2–3 rails for redundancy. - Zero device intelligence

If you don’t track devices/IPs, you’ll get hit with copy/inverse trading rings. This wipes out margins. - Running the back office on spreadsheets

A prop firm is not an Excel business. Without CRM, risk, and monitoring tools, you will break as soon as you scale.

Final Thoughts: Build Smarter, Scale Stronger

Starting a prop firm in 2026 isn’t about hype. It’s about structure. The boring stuff no one likes to brag about but quietly decides whether you’ll still be paying traders by the middle of the year.

The ones that last usually get a few things right:

- They write rules that actually protect them, not whatever they saw on another firm’s website.

- They automate payouts, because there’s nothing worse than juggling spreadsheets while ten traders chase you for their money.

- They invest in proper systems, not whatever plug-and-play dashboard promised to “handle everything.”

- They set up offshore structures that are clean, compliant, and not one bad transaction away from getting their payment accounts frozen.

- They track the numbers properly, because “we think we’re profitable” isn’t a strategy.

Most of the firms that disappeared in 2024-2025 didn’t get unlucky. They just didn’t know what they were doing. Fast launch, louder marketing, faster collapse. It always ends the same way…liquidity problems, delayed payouts, and then silence.

I’ve seen both sides. The quiet operators who build properly and let results speak for them, and the loud ones who burn bright for a month and vanish when traders start asking questions. Traders always figure out who’s real.

So if you’re getting ready to launch in 2026, build something that lasts. Because the industry doesn’t need another firm shouting “next big thing”. It needs one that’s still here next year.

Ready to build? Let’s connect.

“If you’re serious about this, not just talking about it, you can reach out. I actually work in this space.”

FAQ

Do prop firms need a license?

Not in most regions if you run a challenge + simulated trading model. But futures-focused firms in the U.S. need SEC/FINRA licenses. Always check your jurisdiction.

How much does it cost to start a prop firm?

A lean Forex prop firm can start from $20,000–$50,000. Larger setups with futures, custom tech, and marketing can need $70,000+.

What are the best platforms for Forex vs Futures?

Forex/CFD: cTrader, DXTrade, Match-Trader, MT5, Tradelocker.

Futures: Rithmic, NinjaTrader (requires higher capital), Tradovate, Quantower

How long does it take to launch a prop firm?

With white-label tech, 1–3 months. With custom tech and licensing, 6–12 months.

What pass rate is healthy?

2–8% for 2-step models.

6–15% for 1-step models.

Instant funding depends on screening and filters.

How do payouts work?

Most firms offer weekly or bi-weekly payouts. The first payout often has a buffer or delay. Automating payout flows is critical to scaling.

Can a broker add a prop arm?

Yes. Many brokers are adding prop trading arms to diversify revenue. It requires clear separation of regulated brokerage activities from the evaluation business.

Most Viewed Posts

- Prop Firm Marketing: Complete Strategy Blueprint for 2025

- 10 SEO Myths Killing Your Prop Firm’s Rankings (And What to Do Instead)

- Prop Firm Consistency Rules in 2025: Do They Help Traders or Just Increase Failure Rates?

- How Much It Costs to Start a Prop Firm (2025 Cost Breakdown Under $20K)

- Core Web Vitals 2025: How to Improve Site Speed & Rank Higher on Google

Author

-

Alex started his career creating travel content for Jalan2.com, an Indonesian tourism forum. He later worked as a web search evaluator for Microsoft Bing and Google, where he spent over a decade analyzing search relevance and understanding how algorithms interpret content. After the pandemic disrupted online evaluation work in 2020, he shifted to freelance copywriting and gradually moved into SEO. He currently focuses on content strategy and SEO for finance and trading-related websites.

Recent Posts