Introduction: Behind the Scenes of Prop Firms

After spending time breaking down why most remote workers fail and whether hybrid working can actually boost productivity and happiness, I’m back to what I care about most: prop firms and marketing. (And if you’re curious about how these firms are built, I’ve exposed the secret to starting a prop firm for cheap in 2025 here.)

Let’s be honest: most prop firms aren’t built to turn you into the next trading legend—they’re built to make money. Sure, the glossy marketing promises funded accounts, massive profit splits, and dream salaries. Behind the curtain is a cold-blooded system that exists to milk challenge fees from hopefuls, squeeze every ounce of profit from the 1% who survive, and toss everyone else into the “thanks for playing” pile. This system? It’s called the pipeline strategy, and it’s the blueprint for how the biggest names in the game—like FTMO—operate.

Prop firms thrive on a model that profits at every stage of your journey, whether you win or lose. Fail their challenges? They pocket your fees. Succeed? They’ve already built a risk-free setup to make money off your trades. And for the top 1% of traders? Sure, you might get the perks—bigger accounts, better splits, maybe even a salary—but only after you’ve proven you can make them money first.

This isn’t about exposing prop firms as scams; it’s about pulling back the curtain on how they work. It’s business, and it’s clever. If you’re grinding through challenges or eyeing that sweet $200,000 funded account, you need to understand the game you’re playing—and how to win without getting played.

In this article, we’re breaking down the pipeline strategy in full. From FTMO’s multi-step evaluation process to the 5%ers’ salary bait and Lux Trading’s vague promises of stability, we’ll show you how prop firms filter, monetize, and recruit traders. Whether you’re just starting out or already battling through evaluations, this is the no-BS guide to understanding how the system works—and how you can make it work for you.

The Prop Firm Pipeline Strategy: How FTMO Runs the Show

If you’ve heard of prop firms, you’ve definitely heard of FTMO. They’re not just one of the biggest names in the game—they’ve perfected a system that lets them make money at every stage while filtering out only the top traders for elite opportunities. This system? It’s the pipeline strategy, and it’s how FTMO turns evaluation fees, demo accounts, and top talent into massive profits.

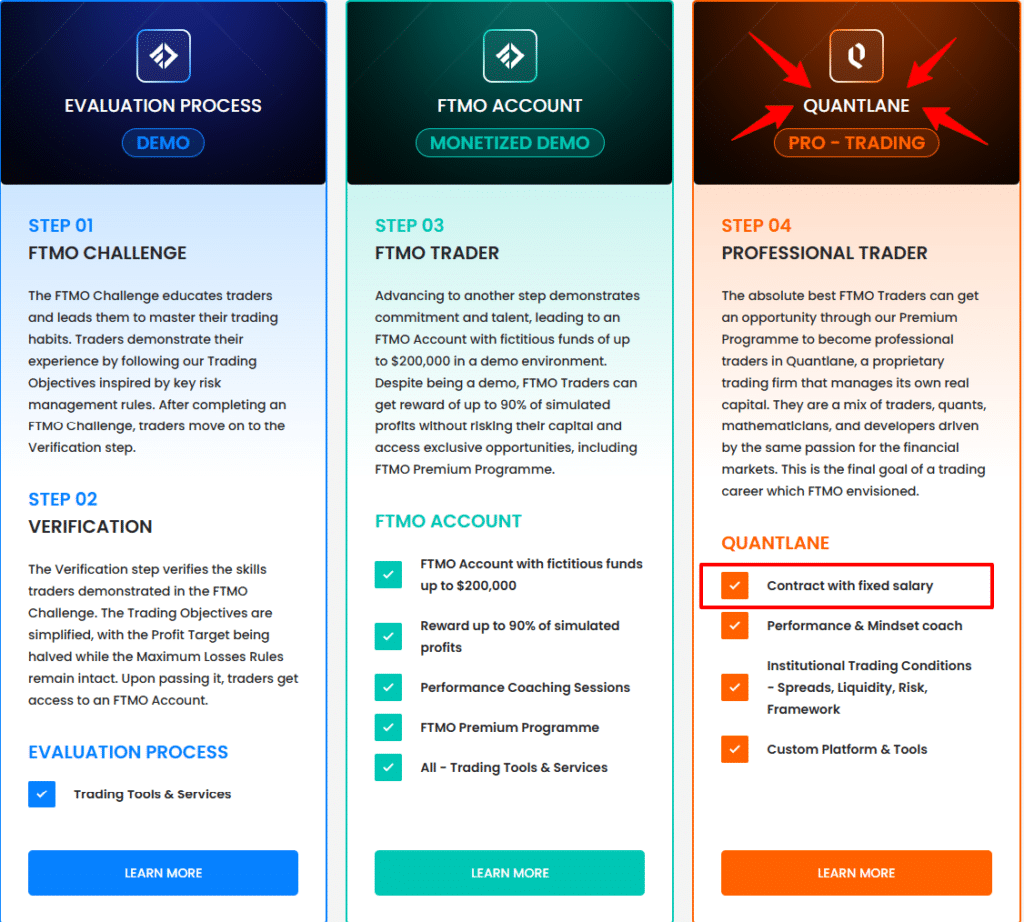

Here’s how the pipeline works, step by step, and why Quantlane—FTMO’s endgame for elite traders—plays a crucial role in their strategy.

Step 1: FTMO Challenge – The Initial Screening

The FTMO Challenge is the first test in the pipeline. Traders are required to hit a 10% profit target while following strict rules on drawdowns and risk. It’s designed to test not just skill, but discipline under pressure.

- Why It’s Tough: Only about 10% of traders pass this stage, making it the biggest filter in the pipeline. The tight loss limits ensure that traders must keep their risk in check, no matter how good their strategy is.

- Where the Money Comes From: Every trader pays a fee to take the challenge, creating a steady stream of revenue for FTMO. Most of these traders don’t pass, and FTMO doesn’t lose a dime on them.

For FTMO, this stage is all upside: low costs, high revenue, and no risk.

Step 2: Verification – The Second Filter

If you’re part of the 10% that clears the Challenge, you move on to Verification. The rules are slightly relaxed here, with the profit target halved to 5%. But the goal remains the same: testing whether you can trade profitably within their rules.

- What Happens Here: Many traders who pass the Challenge fail Verification, tightening FTMO’s filter even further.

- Filtering Talent: FTMO’s profits are locked in from the Challenge fees of traders who don’t make it this far. Verification isn’t about revenue—it’s about filtering talent.

By this point, FTMO has already narrowed its pool of traders significantly, ensuring that only the most disciplined make it to the next stage.

Step 3: Monetized Demo Accounts – Where the Real Profits Begin

Pass Verification? Congrats—you’re now an FTMO Trader with access to an FTMO Account. But the account you’re trading is still demo capital. While the profits you generate are “simulated,” FTMO shares 80% of those with you (up to 90%).

So how does FTMO make money here? Two ways:

- Copy-Trading: When you’re trading on an FTMO account, you’re still on a demo. Yeah, it mirrors real markets, but it’s not real money. Your profits are based on your performance in this simulated setup. FTMO isn’t straight-up copy-trading your moves onto live accounts, but they might use the data from all their traders to guide their own strategies.

- Risk-Free Setup: FTMO doesn’t lose anything if you blow up your demo account—they’ve already collected fees from other traders to cover payouts.

For traders, this stage feels like a win—profitable trades mean real payouts. For FTMO, it’s also a win: they earn from their revenue model (like challenge fees) while supporting profitable traders without risking direct company capital.

Step 4: Quantlane – The Endgame for Top Traders

Quantlane is where FTMO’s pipeline strategy reaches its peak. By this stage, FTMO has identified the top-performing traders from their demo system and funnels them into Quantlane, their proprietary trading firm.

Here’s why Quantlane is the ultimate payoff for FTMO:

- Real Capital: Quantlane operates with live capital, giving traders access to larger positions and tighter spreads than they had on FTMO’s demo accounts.

- Elite Tools and Support: Traders are backed by Quantlane’s team of quants, developers, and software engineers who create and optimize trading strategies.

- Fixed Salaries and Growth Opportunities: For top traders, Quantlane offers stable paychecks alongside performance-based incentives. It’s no longer just about profit splits—it’s a full-time career.

At Quantlane, FTMO maximizes the value of their best traders while minimizing risk. These traders are no longer just “funded”—they’re part of a high-performance team operating in global markets.

How Quantlane Fits Into FTMO’s Pipeline Strategy

Quantlane is the final stage of FTMO’s master plan. Here’s how it ties into the pipeline:

- Filtering for Talent: By the time a trader reaches Quantlane, FTMO knows they’re profitable, disciplined, and capable of handling pressure.

- Scaling Up Profits: Quantlane traders work with live firm capital, allowing FTMO to scale up their trading strategies while keeping profits in-house.

- A New Business Model: At this stage, FTMO shifts from a fee-based model to a talent monetization model, making money directly from the trades of their best performers.

Quantlane’s startup-like culture, focus on innovation, and data-driven approach make it the perfect environment for top traders to thrive—and for FTMO to profit.

Why FTMO’s Pipeline Strategy Works So Well

- Revenue at Every Stage: From challenge fees to copy-trading demo accounts, FTMO profits whether traders win or lose.

- Risk-Free Talent Development: Demo trading ensures that FTMO isn’t risking real capital until traders prove themselves.

- Elite Monetization: Quantlane allows FTMO to turn their best traders into high-value assets, ensuring long-term profitability.

For FTMO, this system is a win at every stage. For traders? It’s a brutal gauntlet with the potential for massive rewards—if you can make it to the top.

The Salary Model: Prop Firm Myth or Marketing Genius?

Here’s the thing: when prop firms start talking about “salaries,” you’d better dig deeper. At first glance, the idea of earning a fixed monthly paycheck while trading sounds good—because most of the time, it is. For the handful of firms that promise salaries, the devil is always in the details. Let’s break down how this works, why it’s used as a marketing hook, and what’s really going on behind the scenes.

The 5%ers: $4K and $10K Salaries at Higher Stakes

The 5%ers used to offer their salary model. They don’t anymore. They used to advertise that traders managing High Stakes accounts could earn a $4,000 monthly salary once they hit $350K in funding and a massive $10,000 per month at the $500K level. Sounds awesome, right?

- Copy-Trading Behind the Scenes: At this stage, you essentially become a signal provider for the firm. They copy your trades to a live account, making 100% profit on their end while letting you earn from your own trades. The value proposition shifts here—you’re no longer just a customer, you’re a service..

- High-Performer Exclusive: Only the best traders—those with a proven track record of consistent wins—ever make it to this level. For the average trader grinding through challenges, this salary might as well be a unicorn.

- Why It Worked: For the 5%ers, the salary model was less about rewarding traders and more about creating a marketing tool. Flashy salaries attract new traders to the pipeline, even if only a select few ever see that kind of money.

Lux Trading: “Stable Salary” or Empty Promise?

Then there’s Lux Trading, who’ve gone all-in on the buzzword “stable salary.” Their pitch is designed to sound like a safety net for traders:

“With us, you earn a stable salary, which allows you to focus on good risk management, as you know your monthly bills will always be covered.”

But here’s the problem:

- No Numbers, No Transparency: Lux doesn’t mention how much this salary is or what conditions traders need to meet to qualify. Is it performance-based? A token amount? Who knows.

- The Copy-Trading Play Again: It’s likely Lux is using the same playbook as the 5%ers—copying trades from their top performers onto live accounts and raking in profits.

- Selling the Dream: Their vague promise of a “stable salary” is aimed at making their firm seem more secure than others. But without clear details, it’s hard to know if this salary is real or just another hook.

Why Prop Firms Use the Salary Model

- Attracting Talent: Salaries sound appealing to traders who are tired of grinding for profit splits. It’s a great way to stand out in a crowded market.

- Marketing Genius: Even if only a handful of traders ever see these salaries, the promise alone brings more challengers into the pipeline.

- Maximizing Returns: By monetizing their top traders’ strategies, firms ensure they’re squeezing every last drop of profit from their pipeline.

Is It Worth It for Traders?

For the few who reach these levels, the salary model can be a solid deal. It provides:

- Stability: Knowing you’ll get paid every month, even during slow periods, can reduce stress and help you focus on long-term strategies.

- Institutional Perks: Salaries often come with access to better trading tools, tighter spreads, and deeper liquidity.

But for the majority of traders, these salaries remain out of reach. The harsh truth is that most traders will never make it past the evaluation stages, let alone to the salary level.

The Big Picture

The salary model is a calculated move by prop firms to monetize their best traders while creating a marketing tool to attract more challengers. For traders, it’s a double-edged sword. If you can make it to the top, the rewards are real. But for most, the promise of a salary is just another dream sold to keep you grinding.

Who Wins and Who Loses in the Pipeline Strategy

The pipeline strategy might look like a win-win on the surface—prop firms make money, traders get funding—but the odds are heavily stacked in the firm’s favor. This system is designed to filter out the majority, monetize every stage of the process, and only reward the elite few who can consistently perform. Let’s break it down.

Who Wins in the Pipeline Strategy?

1. Prop Firms

- Guaranteed Revenue: Prop firms like FTMO and the 5%ers profit massively from challenge and verification fees. Even if 90% of traders fail, the firm still rakes in steady income without taking on real trading risks.

- Risk-Free Trading Profits: By keeping traders on demo accounts and mirroring successful trades onto live accounts, firms make 100% of the profits while sharing only simulated payouts with traders.

- Elite Talent for Cheap: Once a trader makes it through the gauntlet, the firm gets a top-tier performer with little to no training costs. For firms like FTMO, this talent is funneled directly into Quantlane, where they generate even more revenue.

2. The Top 1% of Traders

For the small percentage of traders who reach the upper echelons, the pipeline strategy can actually be worth it:

- Big Payouts: Consistent performers can earn high profit splits—up to 90% in FTMO’s case.

- Institutional Opportunities: Firms like FTMO and Lux Trading offer access to larger accounts, better tools, and even fixed salaries for their elite traders.

- Career Growth: At the Quantlane level, traders aren’t just funded—they’re part of a high-performance team with real capital and career perks.

For these traders, the pipeline strategy is a stepping stone to bigger opportunities, whether it’s trading institutional capital or transitioning to roles like quantitative analysis or risk management.

Who Loses in the Pipeline Strategy?

1. The Majority of Traders

Let’s be real: most traders never make it past the evaluation stages. The system is designed to filter out the majority, and here’s why:

- Strict Rules: Tight drawdown limits and high profit targets make it incredibly hard to pass challenges and verifications.

- Fee Burnout: Traders who fail multiple challenges often lose more in fees than they would’ve risked trading their own capital.

- No Transparency: Hidden rules and vague terms can disqualify traders without warning, adding to the frustration.

The result? Most traders leave the pipeline with less money, more stress, and a bitter taste about prop firms.

2. Aggressive Traders

- Traders who rely on high-risk strategies like scalping or trading during news events often clash with prop firm rules.

- These strategies, while profitable for some, don’t align with the strict risk parameters of most firms, leaving aggressive traders with little chance of success.

3. Mid-Level Performers

- Even traders who pass challenges and get funded often find themselves stuck. Without consistent, high-level performance, they don’t scale their accounts, and payouts remain small.

- These traders are profitable enough to make the firm money, but not enough to break through to larger accounts or salaries.

Why the System is Stacked

The pipeline strategy isn’t about creating success for every trader—it’s about minimizing risk for the firm while maximizing profit.

- Fee-Based Revenue: With thousands of traders paying challenge fees, prop firms are already profitable before a single trade is placed.

- Tight Filters: Strict evaluation criteria ensure that only the best traders make it through, reducing the firm’s exposure to risk.

- Demo-Based Trading: Even funded traders operate on demo accounts, keeping the firm’s real capital completely safe.

How to Make the Pipeline Work for You

If you’re serious about succeeding in the pipeline, here’s what you need to know:

- Understand the Rules: Read every term and condition. Know the drawdown limits, trading restrictions, and payout structures before you start.

- Treat Challenges as Practice: If you’re paying for challenges, use them to refine your strategies, even if you fail the first few times.

- Focus on Discipline: Prop firms reward traders who follow rules and stay consistent. Aggressive or undisciplined trading won’t get you far.

- Have a Bigger Plan: Don’t treat prop firms as your endgame. Use them as a stepping stone to build your skills, track record, and capital for future opportunities.

The Bottom Line

The pipeline strategy is a brilliant business model for prop firms, but for traders, it’s a grind. If you can survive the filters and rise to the top, the rewards are real. But for most, the pipeline is a costly lesson in how rigged the system can feel. The key is to know what you’re getting into—and to treat the pipeline like a stepping stone, not the final destination.

How Prop Firms Monetize Their Pipelines

If you thought prop firms were just handing out free money to traders, think again. Prop firms are businesses first, and their pipeline strategy is designed to maximize profits at every single stage. From the moment you sign up for a challenge to the day you (hopefully) get funded, these firms are raking it in.

1. Challenge and Verification Fees

Let’s start with the obvious: the entry fees. Prop firms charge traders upfront to take their challenges, and these fees are a massive part of their business model.

- FTMO Example: Depending on the account size, you could be paying anywhere from $100 to $1,000+ for a single challenge.

- Why It Works: Most traders fail. And when they do, the firm keeps the fee while risking absolutely nothing.

- A Numbers Game: With thousands of traders entering challenges every month, even a 90% failure rate equals insane revenue for the firm.

For prop firms, challenge fees are the ultimate low-risk cash cow.

2. Scaling Programs

Scaling programs are another revenue stream disguised as an incentive for traders. The idea is simple: perform well, and you’ll be rewarded with a larger account. But here’s the catch:

- Increased Pressure: Larger accounts come with higher expectations, making it even easier for traders to fail.

- Re-Entry Fees: If you blow the scaled-up account, guess what? You’re back to paying challenge fees to start over.

- Risk for the Trader, Not the Firm: Since these accounts are often still demos, the firm takes no additional risk in scaling your capital.

3. Copy-Trading and Signal Monetization

Prop firms don’t just make money from their demo systems—they also profit from your trading strategies. Here’s how:

- Live Account Mirroring: As mentioned earlier, the firm copies your trades from demo accounts to live ones, keeping all the profits on their side.

- Selling Signals: Some firms might package the trading data from their top performers and sell it to hedge funds, brokers, or other traders. Your trades become a product.

- Algorithm Development: Firms use data from their traders to refine automated strategies, leveraging human performance to train AI trading systems.

This is where the relationship shifts: you’re no longer a customer—you’re a resource.

4. Proprietary Trading Desks

At the very top of the pipeline, firms like FTMO transition their best traders into proprietary trading desks like Quantlane. This is where the firm invests real capital into their traders, but even here, they’re still profiting:

- Fixed Salaries + Payouts: For elite traders, firms offer salaries to provide stability, but they’re still banking on profits from larger accounts.

- Institutional Partnerships: By running prop desks, firms position themselves to attract partnerships with hedge funds, banks, and institutional investors.

Quantlane is the prime example: FTMO uses its pipeline to funnel talent into a fully functional prop trading desk, maximizing long-term profits.

5. The Marketing Machine

Everything about the pipeline strategy is designed to feed the marketing engine:

- Success Stories: Firms showcase their top performers to attract new traders. Those $200,000 accounts and 90% profit splits look amazing on Instagram ads, even if only a tiny fraction of traders ever reach that level.

- Salaries as Bait: Promising fixed monthly paychecks at higher levels pulls in traders who dream of stability.

By creating the illusion of massive success, firms ensure a constant flow of new challengers willing to pay fees.

The Real Winners in This System

At the end of the day, the pipeline strategy ensures that prop firms always win, even when traders lose:

- Challenge Fees: Profit from failures.

- Demo Trading: Risk-free profits through copy-trading.

- Scaling Programs: Upsell successful traders with higher-pressure accounts.

- Proprietary Desks: Monetize the elite talent that survives the pipeline.

For traders, the system can work if you’re disciplined, skilled, and understand how the game is played. But for the majority? The pipeline is just an expensive lesson in how prop firms operate.

Conclusion: How Prop Firms Built Their Pipeline Strategy

Prop firms have mastered the art of making money at every step of their pipeline. From challenge fees to demo account profits and elite proprietary trading desks, they’ve built a system where they win whether you succeed or fail. For them, it’s a risk-free money machine, and for most traders, it’s a brutal grind with slim odds.

But here’s the thing: the pipeline isn’t unbeatable. If you approach it with the right mindset, you can still walk away with wins—even if you don’t make it to the Quantlane level.

Key Takeaways for Traders

- Understand the Business Model

- Know that prop firms profit heavily off challenge fees and trader failures.

- Realize that even after you’re “funded,” you may still be trading on demo accounts while the firm mirrors your trades for real profits.

- Treat Challenges as Investments

- Don’t approach challenges blindly. Treat them as a practice ground for refining your trading discipline and strategies.

- If you fail, learn from it. It’s cheaper than blowing up your own live account.

- Stay Disciplined

- Success in prop firms isn’t about being flashy or taking big risks. It’s about following rules, managing risk, and consistently hitting your targets.

- Remember: the system rewards discipline, not aggression.

- Have a Bigger Plan

- Don’t make prop firms your endgame. Use them as a stepping stone to build your skills, track record, and capital.

- Whether it’s transitioning to trading your own funds or landing a role in a proprietary desk like Quantlane, always think beyond the pipeline.

- Be Realistic

- Not everyone will reach the top. The majority of traders fail, and that’s by design. If you’re not improving with every challenge, step back and reevaluate your strategy.

The Final Word

Prop firms aren’t the villains here—they’re businesses. They’ve created a system that works incredibly well for them, and if you can figure out how to navigate it, it can work for you too. But you have to know the rules, play the game smart, and avoid getting caught up in the dream they’re selling.

The key is to treat prop firms as a tool, not a crutch. They’re not here to make you rich—they’re here to make themselves rich. But with the right mindset, discipline, and strategy, you can still walk away with your share of the profits.

So, the next time you’re staring down a challenge fee or dreaming about that $200,000 account, ask yourself: Do you have what it takes to beat the pipeline?

Author

-

Alex started his career creating travel content for Jalan2.com, an Indonesian tourism forum. He later worked as a web search evaluator for Microsoft Bing and Google, where he spent over a decade analyzing search relevance and understanding how algorithms interpret content. After the pandemic disrupted online evaluation work in 2020, he shifted to freelance copywriting and gradually moved into SEO. He currently focuses on content strategy and SEO for finance and trading-related websites.

Recent Posts